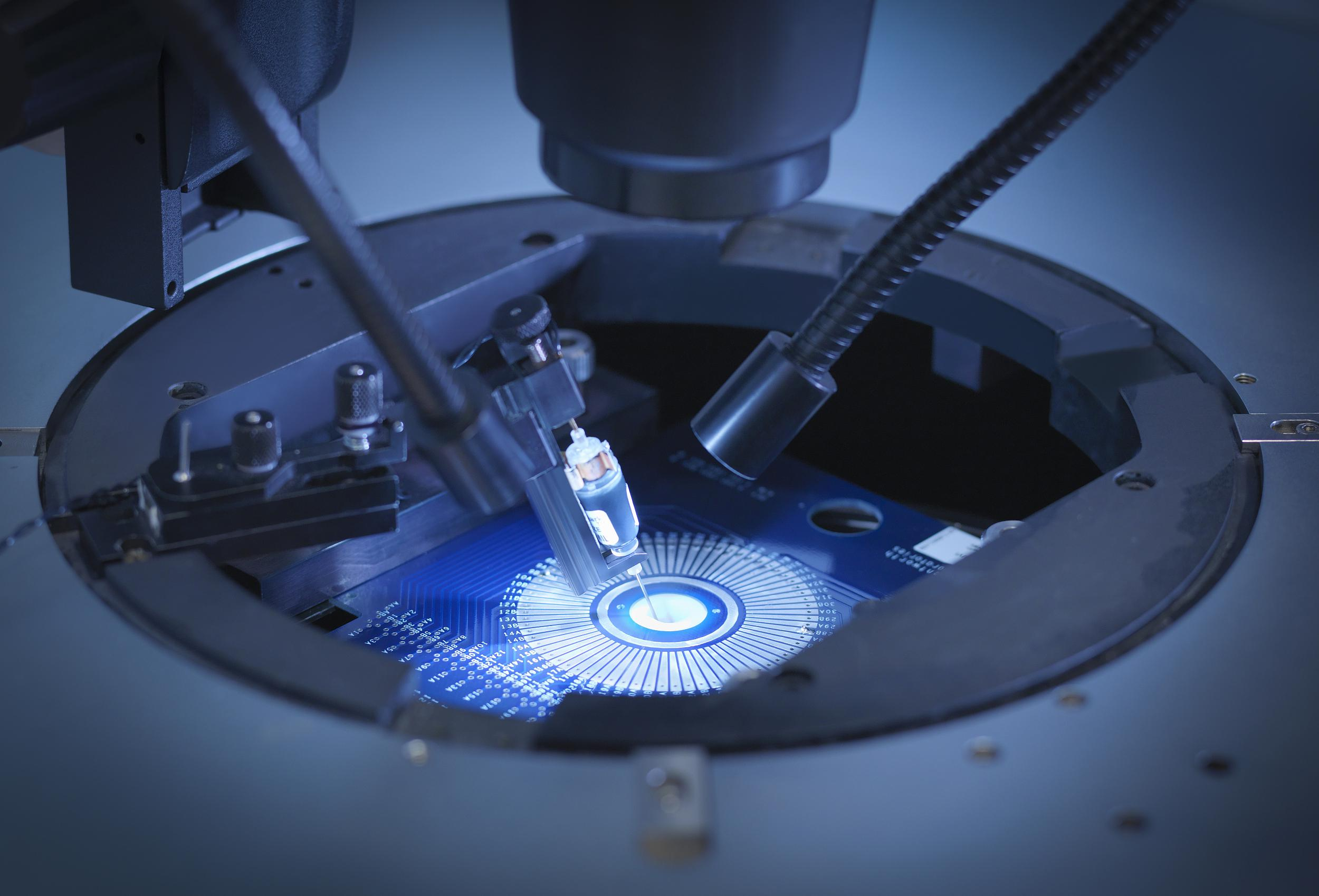

Semiconductor Equipment Capacity Expansion Heats Up in the First Half of the Year

According to the Mid-Year Total Semiconductor Equipment Forecast Report released by SEMI, the global semiconductor manufacturing equipment sales are projected to grow by 7.4% year-over-year in 2025, reaching $125.5 billion, setting a new historical record. This growth is primarily driven by the positive momentum of advanced logic, memory, and technological transformation. In 2026, semiconductor manufacturing equipment sales are expected to further climb to $138.1 billion, demonstrating a strong development trend. Ajit Manocha, President and CEO of SEMI, stated that although the industry is closely monitoring the uncertainties of the macroeconomy, the demand for chip innovation driven by artificial intelligence is continuously fueling investment in capacity expansion and leading production.

Back-End Equipment Demand Surges and Support Policies

In 2025, the demand for back-end equipment is experiencing explosive growth. The sales of testing equipment are expected to increase by 23.2% year-over-year, reaching $9.3 billion, while the sales of packaging equipment are projected to grow by 7.7%, reaching $5.4 billion. This growth trend is expected to continue in 2026, with the growth rate of packaging equipment further rising to 15%, and testing equipment maintaining a 5% growth, achieving continuous expansion for three years. This growth is mainly driven by the significant increase in equipment architecture complexity and the strong demand for high performance from artificial intelligence and high-bandwidth memory (HBM) semiconductors.

In 2025, the demand for back-end equipment is experiencing explosive growth. The sales of testing equipment are expected to increase by 23.2% year-over-year, reaching $9.3 billion, while the sales of packaging equipment are projected to grow by 7.7%, reaching $5.4 billion. This growth trend is expected to continue in 2026, with the growth rate of packaging equipment further rising to 15%, and testing equipment maintaining a 5% growth, achieving continuous expansion for three years. This growth is mainly driven by the significant increase in equipment architecture complexity and the strong demand for high performance from artificial intelligence and high-bandwidth memory (HBM) semiconductors.

Countries are still intensifying their support policies to strengthen local capacities. The United States, leveraging the CHIPS and Science Act, is attracting TSMC and Samsung with $39 billion in factory subsidies and investment tax credits, focusing on building a closed loop of "technology-capacity-market." China's "Fund III" is allocating 300 billion yuan in funds precisely towards equipment and material fields, focusing on breakthroughs in processes below 28nm. The European Union is passing a €43 billion chip bill, aiming to double its global market share by 2030 and to tilt equipment procurement towards local sources. These policies collectively have sparked an investment boom in local semiconductor equipment, significantly driving up related demand and reshaping the global semiconductor industry chain layout.

Global Market Development Diverges

The development of the global semiconductor equipment market is showing a divergent trend. Driven by the strong demand for AI chips, the investment in advanced processes and packaging technologies in Taiwan, China, and South Korea will continue to increase, dominating their expansion cycles. The North American equipment market saw a 55% surge in sales in the first quarter, reaching $2.93 billion, but it decreased by 41% quarter-over-quarter. This fluctuation is closely related to Intel's "pulse purchasing" strategy. However, in the long term, the mass production of the 18A process (GAA technology) is imminent, and this technological breakthrough will support long-term equipment demand. The Japanese semiconductor equipment market also shows a trend of "high year-over-year growth and quarter-over-quarter adjustment." The local company Rapidus has launched a 2nm pilot production line, and the progress of equipment installation at TSMC's Kumamoto factory has jointly driven a 20% year-over-year increase in Japan's semiconductor equipment market. The situation in Europe is relatively severe. Although German wafer fabs have received certain subsidies, they are still unable to resist the trend of industrial hollowing out. After the market crash in the first quarter, the decline in Q2 is expected to continue, facing significant development pressure.

Overall, the divergent trend of the global semiconductor equipment market in Q2 will continue. The strength of AI demand and the evolution of geopolitical factors will become the key variables affecting the development of markets in different regions, driving the continuous adjustment of the global semiconductor equipment market landscape.

Conevo IC Solutions Distributor

Conevo is a leading distributor specializing in high-quality integrated circuit (IC) chips, offering a comprehensive range of semiconductor solutions tailored for diverse applications across various industries. Here are some of popular IC models:

● TPS23754PWPR: A high-performance power switch ideal for industrial applications.

● MCP602-I/SN: A low - power operational amplifier suitable for precision signal processing.

● STM32F103RET6: A versatile microcontroller with high-performance processing capabilities, widely used in embedded systems.

Website: www.conevoelec.com

Email: info@conevoelec.com