Samsung's Memory Strategy: Focus on DRAM Profitability, Suspend HBM Expansion

In the current memory chip market, Samsung Electronics is facing a complex market environment and intense competition. With the rapid development of fields such as artificial intelligence and data centers, the demand for high-performance memory chips continues to grow. However, changes in market supply and demand have also brought many uncertainties. Against this backdrop, Samsung Electronics has adjusted its memory business strategy to cope with market changes and enhance profitability.

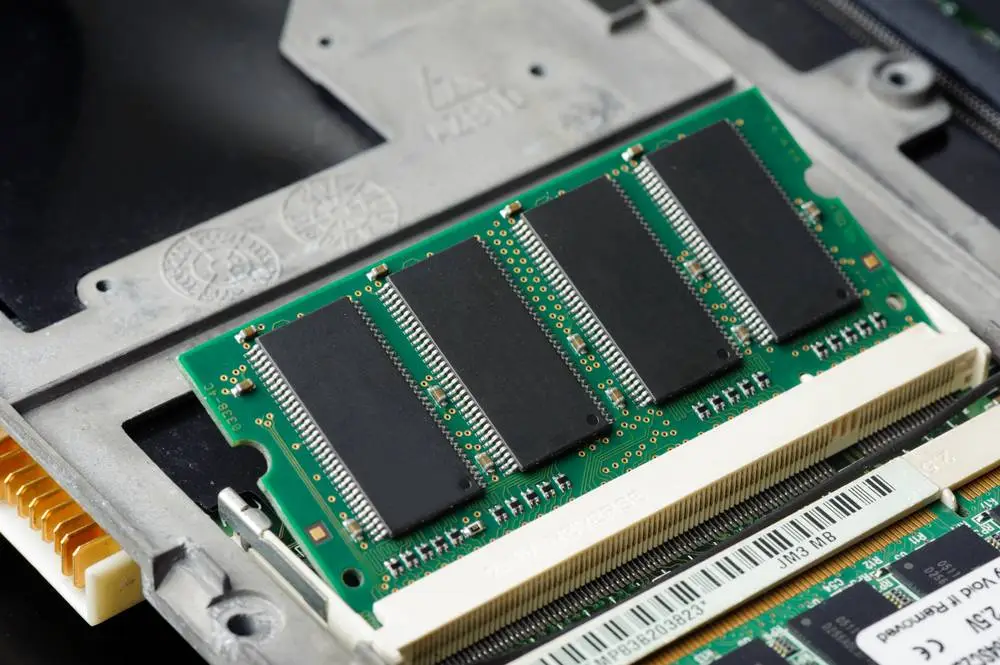

Focus on DRAM: Expand Capacity and Upgrade Technology

Currently, the DRAM market is showing a significant recovery trend, especially with the prices of mainstream products such as DDR5, LPDDR5X, and GDDR7 continuing to rise. According to market reports, the contract price of Samsung's 32GB DDR5 memory module surged from $149 in September to $239 in November, a 60% increase. Faced with this favorable market situation, Samsung has decided to prioritize expanding the production capacity of general-purpose DRAM to enhance overall profitability.

Currently, the DRAM market is showing a significant recovery trend, especially with the prices of mainstream products such as DDR5, LPDDR5X, and GDDR7 continuing to rise. According to market reports, the contract price of Samsung's 32GB DDR5 memory module surged from $149 in September to $239 in November, a 60% increase. Faced with this favorable market situation, Samsung has decided to prioritize expanding the production capacity of general-purpose DRAM to enhance overall profitability.

Samsung plans to expand the mass production scale of its fifth-generation (1b node, 10-nanometer class) DRAM. Specific measures include converting some older process lines (such as the 1z node) to advanced DRAM production and considering reallocating some of the production capacity originally used for NAND flash to the DRAM sector. In addition, Samsung also plans to expand the monthly production capacity of 1c DRAM to 200,000 wafers by the end of 2026, accounting for one-third of the company's total DRAM production. This expansion plan will not only help meet market demand but also further consolidate Samsung's leading position in the DRAM market.

As Samsung's next-generation product, the 1c DRAM adopts advanced multi-layer EUV processes with a line width of less than 11 nanometers. Through technological upgrades and capacity expansion, Samsung will not only enhance the market competitiveness of its products but also achieve significant cost control advantages. This dual advantage in technology and cost will give Samsung a stronger voice in future market competition.

HBM Business: Challenges and Strategic Adjustments

Despite the fact that high-bandwidth memory (HBM) is an important direction for future memory technology, Samsung's HBM business currently faces many challenges. Due to weak orders, the HBM business is still in a loss-making state. Moreover, the yield of HBM4 is not satisfactory, which restricts its commercial profitability. The supply agreement with its core customer, NVIDIA, has not yet been finalized, further delaying the large-scale implementation of HBM4.

Given the current situation of the HBM business, Samsung has decided to suspend related investments and focus on general-purpose DRAM, which has stronger profitability. This strategic adjustment aims to optimize resource allocation and ensure that the company maximizes profits in the short term. However, Samsung is still maintaining its HBM production targets for next year, but the focus will be on increasing DRAM production.

Future Outlook

By focusing on DRAM and expanding its capacity, Samsung is expected to consolidate its dominant position in future market competition. With the continued development of fields such as artificial intelligence and data centers, the demand for high-performance DRAM will remain strong. Samsung's capacity expansion plan will enable it to better meet market demand. At the same time, Samsung's 1c DRAM technology not only enhances the performance and competitiveness of its products but also provides a differentiated advantage for the company in market competition. Through continuous technological innovation and capacity expansion, Samsung is expected to maintain its leading position in the memory chip market in the future.

Conevo Semiconductor Chip Distributor

Conevo, a semiconductor chip distributor, is dedicated to providing high-quality IC solutions for customers worldwide. Conevo offers a wide range of IC products, covering various types such as analog, mixed-signal, and power management, which are widely used in industrial control, communication, automotive electronics, and consumer electronics fields. Here are several popular IC components selected and recommended by Conevo:

● LT1935ES5#TRPBF: A high-precision and low-noise linear voltage regulator, suitable for applications with high requirements for power quality.

● SN65HVD3082EDR: A high-performance CAN transceiver that supports high-speed communication and is widely used in automotive electronics and industrial automation fields.

● W78E058DDG: A classic three-terminal voltage regulator that offers a stable 5V output and is suitable for a variety of electronic devices.

Website: www.conevoelec.com

Email: info@conevoelec.com