With the rapid development of autonomous driving technology, China is becoming the focus of the global autonomous driving technology competition. In this technological revolution, intelligent driving capability has become a key indicator to measure the technical strength of automotive enterprises. Autonomous driving technology is transitioning from Level L2+ to Level L3, while also achieving commercial application in specific scenarios such as logistics, ports, and mines. In this process, the "trilogy" of autonomous driving perception systems—millimeter wave radar, LiDAR, and pure vision perception technology—plays a crucial role.

4D Imaging Radar: Technological Breakthroughs and Market Favorites

4D imaging radar, with its revolutionary technological advancements, is reshaping the future of autonomous driving perception systems. A report from Yole Developpment predicts that the market for 4D imaging radar will grow at an astonishing rate, soaring from 200 million in 2022 to 2.2 billion by 2028, with a compound annual growth rate as high as 49%. This growth is not only due to the significant improvements in resolution and detection accuracy of 4D imaging radar but also because of its potential applications in Level L2+ and L3-L5 autonomous driving.

4D imaging radar can provide a detection distance of over 300 meters and a resolution of less than 1 degree. Its output of point cloud information can offer a more precise environmental description for ADAS systems. Technological advancements, especially the continuous improvement of MMIC chip technology, have significantly reduced the cost of automotive millimeter wave radar systems, thus driving rapid market expansion.

LiDAR: Cost Reduction and Market Reshaping

The LiDAR market is undergoing a cost revolution. With technological progress and mass production, the cost of LiDAR is continuously decreasing, with some products entering the thousand-dollar range. This change makes the application prospects of LiDAR broader, especially in the field of ADAS.

The competitive landscape of the global LiDAR market is also changing. Chinese companies such as RoboSense and Hesai Technology hold significant positions in the global market. RoboSense's financial report for the first quarter of 2024 shows that its LiDAR product sales increased by 457.4% year-on-year, revenue increased by 149.1%, and the gross margin improved to 12.3%, demonstrating the strong growth momentum of the LiDAR market.

However, behind the high-profile market performance, there are also concerns. Some international giants, such as Bosch, have announced their exit from the development of high-end autonomous driving LiDAR sensors, turning their attention to other sensing technologies. At the same time, with the rise of the light map mode, the demand for LiDAR in newly listed vehicle models is decreasing, posing a certain challenge to the LiDAR market.

Pure Vision Perception: AI Algorithm Enhancement and Challenges

The pure vision solution adopted by companies like Tesla, through the upgrade of AI algorithms and cost-effective considerations, is gradually becoming a new choice in the market. The number of 8-megapixel cameras being equipped is increasing rapidly, providing autonomous driving with a longer detection distance and higher quality image information.

The advantage of the pure vision solution lies in its lower cost and ease of large-scale deployment, and with the development of technologies such as deep learning, it has made significant progress in object recognition and scene understanding. However, this solution requires a high demand for algorithms, necessitating a large amount of data for training, and its detection accuracy is also easily affected by weather and environmental factors.

Market Dynamics and Technological Integration

Currently, the market for autonomous driving perception systems shows a trend of diversification. On the one hand, millimeter wave radar technology is transitioning from SiGe to RFCMOS, with 24GHz sensors gradually being replaced by 77GHz sensors, further reducing costs. On the other hand, with the rise of the BEV+Transformer model, the light map mode is becoming a new trend in smart driving, affecting the market demand for LiDAR.

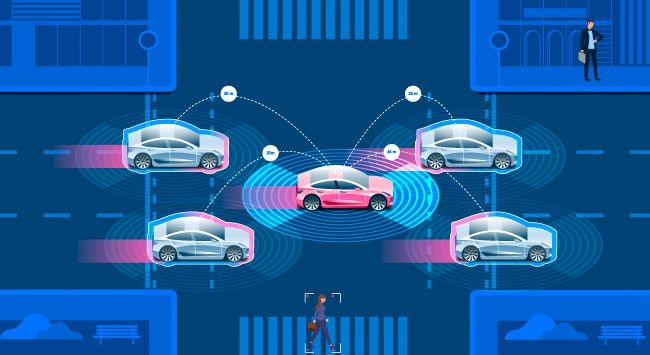

In addition, as autonomous driving technology develops to higher levels, the perception solution of multi-sensor fusion is becoming the choice of more and more car companies. This solution can fully utilize the advantages of various sensors, improve the redundancy and reliability of the system, and provide more comprehensive and accurate perception capabilities for autonomous driving.

Conclusion

The continuous advancement of autonomous driving technology is driving innovation in perception systems and market development. From the rapid growth of 4D imaging radar to the cost reduction of LiDAR, and then to the upgrade of AI algorithms in pure vision solutions, the autonomous driving perception system is undergoing unprecedented changes. With the integration and innovation of technology, the future of autonomous driving will be safer, smarter, and more efficient. Automotive companies need to keep up with market trends, continuously optimize and upgrade their perception systems, and maintain a leading position in the fierce market competition.

Website: www.conevoelec.com

Email: info@conevoelec.com