$165 billion Investment in US Chips: TSMC Faces Challenges in Recouping Costs

Under the pressure and policy incentives of the US government, TSMC has significantly increased its investments in the United States in recent years. TSMC plans to build multiple advanced process chip factories in Arizona and other locations in the US, with a total investment of up to $165 billion. This investment scale is equivalent to approximately 1.2 trillion yuan, making it one of the largest investments in the US semiconductor sector in decades. However, the significant challenge TSMC faces is how to recoup this huge investment in future operations.

Profit Plunge and Cost Pressure

In the second quarter of 2025, TSMC's US subsidiary delivered a promising financial report, with the first-phase factory generating a profit of 4.232 billion New Taiwan dollars after mass production. However, in the third quarter, the profit plummeted to only 410 million New Taiwan dollars, a 99% drop from the previous quarter. This dramatic fluctuation in profit is primarily due to the following factors:

In the second quarter of 2025, TSMC's US subsidiary delivered a promising financial report, with the first-phase factory generating a profit of 4.232 billion New Taiwan dollars after mass production. However, in the third quarter, the profit plummeted to only 410 million New Taiwan dollars, a 99% drop from the previous quarter. This dramatic fluctuation in profit is primarily due to the following factors:

● Increased Profit from First-Phase Mass Production: Although the first-phase factory has started production and is generating profit, the second-phase factory is still under construction and is expected to complete installation in the second quarter of 2026.

● Huge Depreciation and Construction Costs: The construction cost of the Arizona factory is much higher than that in Taiwan, with wafer manufacturing costs being 30% higher than in Taiwan. Additionally, the construction of the second-phase factory requires significant capital investment, leading to a substantial increase in depreciation and construction costs.

● Market Demand and Capacity Utilization: Despite the first-phase factory's capacity being fully booked by major clients such as Apple and AMD, fluctuations in overall market demand and the investment in the second-phase factory have severely impacted overall profit.

Uncertainty in Investment Returns

From the fourth quarter of 2024 to the third quarter of 2025, TSMC's US company reported profits of -4.98 billion, 496 million, 4.232 billion, and 41 million New Taiwan dollars. Although the company achieved profitability in some quarters, it still remains in a slightly loss-making state overall. Looking ahead, TSMC plans to produce more advanced 3nm and 2nm process chips in the US and introduce High NA EUV lithography machines worth $400 million each. The transfer of these advanced processes and the introduction of new equipment will further increase costs, adding to the uncertainty of investment returns.

Conclusion

TSMC's $1.2 trillion investment in the US is a crucial step in its global strategic layout, but the path to recouping costs is fraught with challenges. Faced with significant cost pressure and the uncertainty of market demand, TSMC needs to demonstrate exceptional management capabilities in operational efficiency, cost control, and technology transfer. In the coming years, the return on TSMC's US investment will have a significant impact on its global market position and profitability.

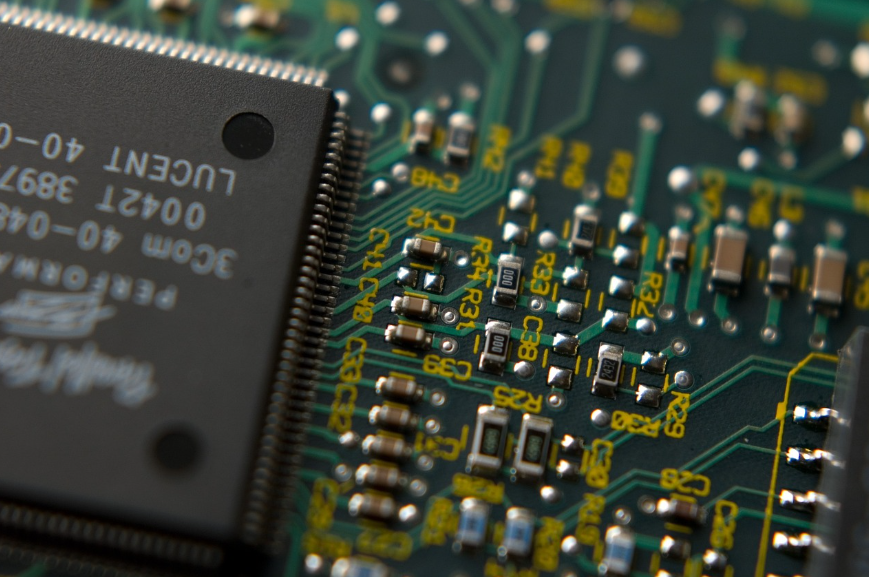

Conevo Distributor and Popular IC chips

Conevo is a global distributor of high-performance semiconductor chips, dedicated to providing customers with a wide range of IC chip lines. Conevo's products cover key areas such as analog, radio frequency, power management, signal processing and storage, and are committed to meeting the needs of different industries. The popular IC models provided by Conevo include:

● AD9755AST: High-performance 16-bit digital-to-analog converter, suitable for high-precision signal processing applications.

● MT40A1G8SA-062E:E: 1Gb DDR4 memory chip, low-power design, suitable for embedded systems.

● TPS65130RGER: High-efficiency power management IC, supporting multiple power configurations, suitable for mobile devices and Internet of Things devices.

Website: www.conevoelec.com

Email: info@conevoelec.com